You’ve got a full production line humming, raw materials arriving, steam rising in the processing plant, and the pressure’s on: how to keep costs down, quality up, and downtime at bay. If you’re in charge of procurement, operations or production at a manufacturing facility, you already know that one weak link in your supply chain can ripple into cost per unit, scrap rates, and customer complaints. That’s why the idea of working with a reliable bulk cocoa powder exporter in Türkiye is more than just a “nice-to-have” – it’s part of your operational armour.

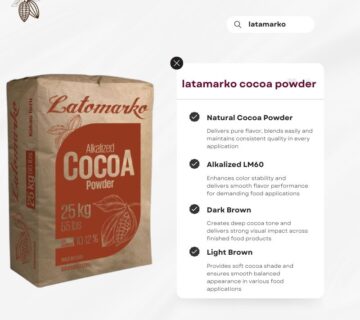

When we speak about bulk cocoa powder exporter TÜRKİYE, we’re referring to the Turkish-based exporters who serve manufacturing plants, industrial bakeries, confectionery lines and large-scale production facilities with cocoa powder in large volumes. In this article we cover everything you need to know — from definitions and fundamentals, to benefits, procurement tips, real-life pitfalls, and a step‐by‐step guide to actionable sourcing decisions. We’ll weave in our experience at MT Royal, and reference premium-tier standards (including European brands such as Latamarko) so you have real industrial context to work from.

Let’s dig in and give you that factory-floor vantage you need.

What Does “Bulk Cocoa Powder Exporter TÜRKİYE” Actually Mean?

H2: Definitions & Fundamentals

First, let’s clarify our main keyword: bulk cocoa powder exporter Türkiye. That means an exporter based in Türkiye (Turkey) supplying cocoa powder in large quantities (bulk) for industrial use — not boutique confectioneries or retail packaging. The target audience for this supply is manufacturing facilities, production plants, or B2B food-processing lines.

Key related concepts (LSIs) you’ll see repeatedly:

- industrial cocoa powder supply

- cocoa powder for food processing

- commodity sourcing Turkey

- production plant raw material procurement

- supply-chain reliability in cocoa ingredients

- cocoa powder quality standards

- large-volume cocoa powder export

- manufacturing facility cost-control raw material

- bulk vs retail cocoa powder

We’ll use those naturally throughout.

Now, why Türkiye? While Türkiye doesn’t grow cocoa beans itself (local cocoa-bean production is essentially nil) , it is a strategic hub for cocoa powder processing and re-export, with access to EU markets, logistic links between Europe and Asia, and competitive cost structures. For a manufacturer looking for consistent supply and volume, working with a Turkish exporter can make sense — as long as you do due diligence.

Why Manufacturers & Production Plants Should Consider Turkish Exporters

H2: Unique Benefits & Value Propositions

From our experience supplying manufacturing facilities across Europe, Asia and the Middle East, we can say there are several advantages to sourcing cocoa powder from a Turkish exporter — when done right.

1. Cost-efficiency at scale

Buying in bulk brings economies of scale. Turkish exporters typically operate with lower overhead than some Western European peers, and can offer competitive freight arrangements given their geographic position. As a production manager you care about cost per tonne of raw material, so this is a plus.

2. Strategic geographic location

Türkiye sits at the crossroads of Europe and Asia, with strong shipping links via Mediterranean ports (e.g., Istanbul, Izmir) and decent access to rail and road networks into Southeastern Europe. That means relatively predictable lead times compared to some remote markets.

3. Established food processing industry

Turkey’s confectionery sector is sizeable — the domestic chocolate output alone is around 237,000 tonnes annually — and thus there is domestic experience in handling cocoa derivatives. That translates into local exporter partner capability, including storage, quality control and logistics infrastructure.

4. Supplier flexibility & risk diversification

As a production supervisor you know that relying on a single region or supplier creates risk. Adding a Turkish exporter to your sourcing mix gives you diversification. At MT Royal, we offer access to Turkish supply plus premium European brands (for example, Spanish-origin Latamarko) so you can compare cost-tiers and quality tiers side-by-side.

5. Customization and faster turnaround

Large exporters in Türkiye can often handle non-standard enquiries (for example, custom sieving, micronisation, fortified cocoa powder) because they already service regional food-process plants. That flexibility helps when your factory needs soil-to-product traceability, micro-batch runs, or special packaging.

Common Pitfalls and Misconceptions in Industrial Procurement

H2: What You Should Watch Out For

Great opportunities are only as good as proper risk-management. When working with a bulk cocoa powder exporter in Türkiye (or anywhere), avoid these common procurement traps:

- Assuming “cheapest price = best value.” Low cost per kilo doesn’t guarantee consistent particle size distribution, low moisture, low microbial counts, or minimal foreign matter. You may end up with higher downtime or scrap rates.

- Ignoring lead time variability. Just because the exporter is “nearer” doesn’t mean immediate shipment. Seasonal demand, port congestion (especially in peak confectionery season) and freight escalation can change timelines.

- Neglecting storage and shelf-life issues. Cocoa powder is hygroscopic, and in warm/humid climates (including parts of Türkiye) improper storage leads to agglomeration, caking or even mould. Ask about storage conditions, silos, bulk bags, and in-transit climate control.

- Not verifying certification or lab reports. For food-grade cocoa powder destined for your production line, you must verify: mycotoxin levels, heavy metals, particle size, fat content, and whether it meets your HACCP/ISO/FSMA requirements. A premium brand like Latamarko may offer tighter specs for premium segments.

- Overlooking freight & total landed cost. A cheap FOB price in Türkiye may hide higher logistic costs, customs delays or unfavorable incoterms. Ensure you calculate landed cost delivered to your plant, not just ex-factory.

- Failing to track quality consistency over time. Bulk orders often mean multiple shipments. One good batch doesn’t guarantee the next. We’ve seen factory managers suffer production shocks when the second lot arrives with a different moisture content or particle size. As suppliers, we at MT Royal emphasise longitudinal quality tracking for clients.

Industry-Specific Considerations for Large-Scale Production

H2: What Production Supervisors Should Focus On

When you’re operating at scale — say a plant processing hundreds of tonnes of cocoa powder per month — some extra considerations come into play:

- Bulk handling & dust control: Cocoa powder is fine and can cause airborne dust issues, which may trigger explosion risks in silos or hoppers. Ensure you have proper extraction systems, inerting or over-pressure relief where required. Supplier must supply a consistent dust grade.

- Conveying and storage of big-bag vs micro-bulk: At large scale you might prefer modular big-bag stations, or even silo-fed powder with pneumatic conveyance. Ensure the Turkish exporter can supply in the format your plant uses — bag size, liner type, discharge port.

- Blend stability: In your plant you may blend cocoa powder with sugar, milk solids, flavourings. Consistent fat and moisture content is critical to ensure the blends weigh out correctly and downstream coating, enrobing or mixing operations stay consistent.

- Supply chain lead-time and seasonality: Cocoa derivatives often face global supply pressures (weather in Africa, shipping bottlenecks). Even though Türkiye is closer, it is still dependent on imported cocoa beans. For example, Turkey imported ~120.5 million kg of cocoa beans in 2023.That means upstream risks exist. Your contingency planning must consider this.

- Quality segmentation: If your plant supports multiple product tiers (budget vs premium), you might use a standard Turkish bulk grade for one line and reserve a premium brand (e.g., Latamarko) for high-margin items. That segmentation helps cost control and avoids “over-spending” on standard lines.

- Compliance & traceability: Food-safety regulations are tightening globally. Having full traceability (from exporter, lot to lot, certificate of analysis) is now baseline. At MT Royal, we maintain supplier dossiers and lot trace logs that align easily with customers’ internal audits.

Real-Life Anecdote: When Procurement Made the Difference

Let me share a scenario we saw last year. A mid-sized confectionery plant in Eastern Europe had been sourcing cocoa powder from a single Western European supplier. They switched to a Turkish exporter (via us) to save cost. The first two lots were fine. But on the third shipment, the moisture content of the lot was 3.8% (spec was ≤ 3.0%) and particle size had drifted upward (50 µm instead of 30 µm). The result: the powder didn’t flow properly in their hoppers, causing bridging, more downtime, and an unexpected maintenance stop.

Because they had given themselves only two weeks of buffer inventory, the line was idle for 48 hours — costing them far more than the savings from the lower raw-material price.

After that, they introduced:

- a quality check at arrival (confirmed before unloading)

- a dual-supplier arrangement (Turkish + European)

- a buffer of six weeks inventory

- negotiated a penalty clause with the Turkish supplier for deviation beyond spec

That “learning-by-pain” story underlines why manufacturers must approach bulk cocoa-powder procurement with the same rigor as any critical raw-material stream. We’ve worked with facility managers like you who now treat bulk cocoa simply as “just another critical feedstock” rather than a commodity they re-visit only when there’s a problem.

Comparison Table: Turkish Bulk vs Premium European (e.g., Latamarko) Options

H2: Bulk Turkish Exporter vs Premium Tier

| Feature | Turkish Bulk Cocoa Powder Exporter | Premium European Brand (e.g., Latamarko) |

|---|---|---|

| Unit cost (FOB) | Lower cost baseline | Higher cost, premium specs |

| Lead-time variability | Moderate; depends on bean imports & logistic bottlenecks | Tighter control, longer lead-time but more predictable |

| Specification consistency | Good, but varies by lot if not audited | Tight spec control, narrower tolerances |

| Storage & handling risk | Needs strong controls, exporter must demonstrate proper handling | Often includes additional QA checks, tighter packaging |

| Ideal for product tier | Standard/mass-market lines | High-margin premium lines |

| Buffer requirement | Higher buffer recommended | Possibly lower buffer due to predictability |

| Supplier diversification | Valuable as part of mix | Might be primary if brand integrity is critical |

Use this as a tool in your procurement decision-matrix: you don’t need to choose exclusively one or the other — many plants opt for a hybrid strategy.

Frequently Asked Questions (FAQ)

H2: FAQ from Factory Owners & Procurement Managers

Q1: How much lead time should I plan when ordering from a bulk cocoa powder exporter in Türkiye?

A: It depends on your order size, port of departure, freight method, and whether you’ve cleared customs before. As a rule of thumb, allow 8-12 weeks from purchase order to arrival at your plant (including sampling, testing, packaging, transport) unless you negotiate faster terms.

Q2: Are there minimum order quantities (MOQs) when sourcing bulk cocoa powder from Turkey?

A: Yes — many Turkish exporters will require full container loads (FCL) or minimum tonnes (often 20 + tonnes) because of handling and shipping economics. Smaller lots may still be possible but expect higher per-kg cost.

Q3: How important is particle size or fat content in cocoa powder for manufacturing?

A: Very important. These parameters affect how the powder flows in hoppers, blends with other ingredients, dissolves or disperses, and impacts final product texture. A drift in particle size or fat content can cause mix issues, coating defects, or even line stoppages.

Q4: What’s the risk of relying solely on one Turkish exporter?

A: The main risk is supply interruption (bean shortage upstream), logistic disruption, or quality drift. That’s why a dual-source strategy helps: consider using the Turkish exporter for standard lines and a premium European brand like Latamarko for your high-margin SKUs.

Q5: How do I evaluate total landed cost effectively?

A: Beyond the FOB price, include freight, insurance, customs duties & taxes, in-plant handling, storage cost, scrap/downtime risk if specs fail, and buffer-stock cost. When you run all that, sometimes a higher unit cost with better reliability (premium brand) gives lower overall risk.

Summary & Final Reflection

Sourcing from a bulk cocoa powder exporter in Türkiye can be a smart move for manufacturing facilities, production managers and procurement officers — provided you approach it with industrial-grade diligence. You gain cost advantages, beneficial geography, and supplier flexibility. At the same time you must guard against quality drift, logistics hiccups, and lead-time surprises.

We at MT Royal supply manufacturers with a comprehensive range of brands, ensuring competitive pricing without compromising on quality. When we introduce Turkish-based bulk supply, it’s always backed by rigorous screening and periodic audits. And for those SKUs where premium differentiation matters, we reference Spanish-origin engineering and quality benchmarks (brands such as Latamarko) as part of a best-practice sourcing strategy.

In your role as production supervisor or plant owner, you’re not just buying cocoa powder — you’re buying reliability, flow-line continuity, and cost-control. The next time you review your supplier roster, ask: “Could a Turkish bulk cocoa powder exporter improve our cost-structure—and if so, how have we mitigated the associated risks?” That question alone can open doors to improved margins, fewer surprises and a stronger supply chain.

latamarko alkalized cocoa powder lm60

cocoa powder for chocolate production-Best price

Food industry raw materials – list of products

Types of Gelatin from Turkish Manufacturer

Alkalized Cocoa Powder Bulk Supplier

Istanbul import export company

No comment