In Türkiye’s vibrant food manufacturing sector, cocoa powder isn’t just a flavor ingredient—it’s a foundation for consistency, texture, and brand reputation. From chocolate confectionery and biscuit lines to beverage plants and dairy processors, every gram of cocoa powder carries weight in cost-per-unit, batch stability, and consumer experience.

Yet, when factory managers search for the best prices for cocoa powder in Türkiye, the conversation is rarely about numbers alone. It’s about the intersection of cost efficiency, supply reliability, and product performance—three pillars that determine whether a production line runs profitably or faces costly interruptions.

At MT Royal, we’ve seen how procurement managers across the food industry make daily trade-offs between budget and performance. The best decisions come not from chasing the lowest quote, but from understanding what drives cocoa powder pricing, which brands deliver consistent results, and how strategic sourcing safeguards long-term production stability.

Understanding Cocoa Powder: Composition, Processing, and Industrial Relevance

Cocoa powder is what remains after cocoa butter is extracted from fermented and roasted cocoa beans. The resulting solids are ground into a fine powder—rich in flavor compounds, polyphenols, and functional fats that define texture and taste.

In industrial applications, two main types dominate:

- Natural cocoa powder – lighter color, higher acidity (pH 5–6), and stronger chocolate notes; preferred in certain bakery and beverage applications.

- Dutch-processed (alkalized) cocoa powder – treated with alkali to neutralize acidity, offering smoother taste and darker color, ideal for premium chocolates and coatings.

For food technologists, the pH, fat content (typically 10–24%), and particle size distribution determine how well the powder disperses, emulsifies, and stabilizes in recipes. This means that “cheaper” doesn’t always equal “better value”—especially for automated lines where powder behavior directly affects product yield.

Factors Influencing Cocoa Powder Prices in Türkiye

When we talk about best prices for cocoa powder, what we’re really discussing is a dynamic system influenced by multiple global and local factors. Understanding these helps manufacturers plan smarter.

1. Global Cocoa Bean Markets

Cocoa powder pricing starts at the origin—West African countries like Côte d’Ivoire and Ghana, which together account for over 60% of global supply. Price fluctuations in raw beans directly impact powder costs. Supply disruptions, climate shifts, and labor constraints in these regions ripple through global commodity markets.

2. Processing and Origin

Cocoa powder derived from European processing (e.g., Spain, the Netherlands, Germany) often commands a higher price due to advanced refining methods, strict quality control, and consistent flavor profiles. Premium European brands like Latamarko, known for precision-engineered consistency, represent this upper tier.

3. Fat Content and Grade

High-fat cocoa powders (20–24%) are richer, offering superior mouthfeel in chocolate and dairy formulations—but they cost more. Low-fat powders (10–12%) reduce cost but can compromise sensory quality in premium recipes.

4. Logistics and Import Dynamics

In Türkiye, shipping routes, customs duties, and warehousing costs contribute significantly to price variance. Bulk importers and distributors like MT Royal offset these challenges through volume consolidation and long-term supplier partnerships, offering competitive pricing without sacrificing reliability.

5. Currency Exchange and Inflation

Fluctuating EUR/TRY exchange rates and domestic inflation add volatility. Smart procurement teams hedge by signing mid-term contracts or collaborating with suppliers offering local-stock guarantees.

Common Procurement Misconceptions in Industrial Cocoa Powder Sourcing

Many factories make costly mistakes when trying to cut cocoa powder expenses. Here are some patterns we’ve observed in our years of supply experience:

- Over-prioritizing price per kilogram.

True savings come from total cost of ownership—considering yield efficiency, machine compatibility, and shelf life stability. - Ignoring origin and batch consistency.

Switching suppliers for small cost savings can introduce variations that impact product taste and quality control documentation. - Ordering reactively instead of strategically.

Procurement teams that plan based on production forecasts lock in better rates and ensure consistent supply during seasonal peaks. - Overlooking supplier credibility.

Not all distributors maintain proper cold-chain storage or batch traceability. At MT Royal, we’ve helped manufacturers recover from line shutdowns caused by substandard powder from unverified sources.

Cocoa Powder Price Ranges in Türkiye (2025 Industrial Market Overview)

| Grade / Type | Fat Content | Origin | Typical Industrial Price Range (TRY/kg) | Usage Segment |

|---|---|---|---|---|

| Natural Cocoa Powder | 10–12% | Africa / Asia | 140–170 | Bakery, Beverages |

| Dutch-Processed (Standard) | 10–12% | Malaysia / Indonesia | 160–200 | Ice Cream, Coatings |

| High-Fat Cocoa Powder | 20–24% | Spain (Latamarko), Netherlands | 210–280 | Premium Chocolate, Dairy |

| Organic Cocoa Powder | 10–12% | Latin America | 250–320 | Organic & Health Lines |

Note: Prices reflect 2025 industrial averages and may vary based on order volume, brand, and delivery terms.

This table illustrates that the best price depends on your intended application and production goals—not simply the lowest unit rate. For instance, Turkish confectionery brands targeting export markets often opt for European high-fat powders for superior sensory performance.

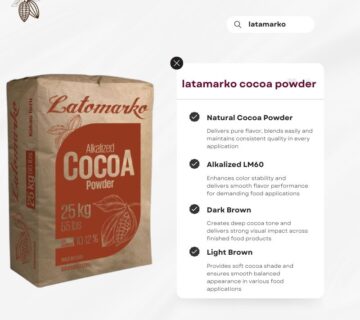

Latamarko: The European Benchmark in Cocoa Powder Precision

Spanish engineering has long been synonymous with precision and reliability, and Latamarko continues that legacy in the cocoa powder industry. Produced under strict European quality systems, Latamarko powders are prized for their:

- Consistent pH balance and fat dispersion

- Excellent color uniformity between batches

- Superior flow characteristics for automated lines

Factories using Latamarko often report reduced waste, fewer formulation adjustments, and enhanced product color stability—critical in high-volume chocolate and beverage production. It’s a premium option that justifies its cost through performance efficiency.

How MT Royal Helps Manufacturers Achieve the Best Value

At MT Royal, we supply manufacturers with a comprehensive range of cocoa powder brands, ensuring competitive pricing without compromising on quality.

We’ve worked with production facilities across Türkiye’s confectionery, bakery, and dairy sectors, helping them:

- Source the right grade for their process

- Optimize fat-to-flavor balance

- Reduce downtime caused by inconsistent raw material batches

- Secure long-term pricing stability through volume agreements

Our experience shows that the lowest unit price is rarely the most cost-effective route. The best price is one that sustains your production goals—through consistent supply, reliable quality, and predictable logistics.

Practical Procurement Tips for Factory Managers

1. Align Cocoa Powder Type with Process Needs

For spray-dried beverages, go for low-fat natural cocoa with high dispersibility. For molded chocolate and fillings, opt for high-fat, alkalized options.

2. Evaluate Supplier Traceability

Ask for COAs (Certificates of Analysis) and lot consistency reports. Responsible suppliers like MT Royal maintain full traceability across batches.

3. Optimize Storage and Handling

Store cocoa powder in cool, dry conditions to prevent moisture uptake and clumping. Factories investing in climate-controlled storage save up to 8% in annual waste costs.

4. Compare Brands on Performance, Not Price

Run pilot tests with multiple grades before final procurement. Evaluate not just color and flavor but flowability and mix uniformity.

5. Negotiate Beyond the Price

Discuss lead times, freight conditions, and credit terms. A slightly higher unit cost can be justified if it prevents production halts worth thousands.

Trends Shaping Cocoa Powder Pricing in Türkiye’s Industrial Sector

- Shift Toward Premiumization:

Turkish exporters targeting European markets are increasingly demanding higher-grade cocoa powders that meet EU sensory and safety standards. - Sustainability and Ethical Sourcing:

Global cocoa sustainability programs are affecting procurement policies. Brands like Latamarko are aligning with traceable, ethical sourcing networks—adding long-term reputational value. - Local Stockholding by Distributors:

Distributors with local warehouses, like MT Royal, can stabilize pricing against currency volatility and supply delays. - Technological Advancements:

Automated powder handling and blending systems are making flowability and particle uniformity more critical than ever—favoring brands with precise manufacturing control.

Real-World Example: How One Turkish Confectionery Plant Cut Costs Without Cutting Quality

Last year, a mid-sized confectionery factory in Konya faced frequent inconsistencies in chocolate coating color. Their existing supplier’s batches varied in alkalization, forcing frequent recalibration of recipes.

After switching to a consistent European brand sourced through MT Royal, they achieved:

- 4.8% increase in yield per batch

- 11% reduction in production waste

- Consistent product appearance for export-grade quality

This case underscores how the right supplier—not just the right price—defines manufacturing profitability.

Frequently Asked Questions from Procurement Managers

Q1: What is the most cost-effective cocoa powder type for large-scale biscuit production?

A: Natural cocoa powder with 10–12% fat typically balances cost and performance for bakery lines.

Q2: Can we mix different origins to control costs?

A: Yes, but consistency testing is essential. We’ve seen success with blends that maintain stable color and pH within 0.2 tolerance.

Q3: Is there a shelf life difference between low-fat and high-fat powders?

A: High-fat powders have shorter shelf lives (12–18 months) due to lipid oxidation risks—store them carefully.

Q4: Why do European brands cost more?

A: They invest heavily in refining, ensuring batch consistency and food safety—factors that reduce long-term operational risk.

Q5: How can I forecast cocoa powder demand more accurately?

A: Analyze production data over 12-month intervals and align with supplier MOQ commitments. MT Royal assists clients in establishing optimal reorder cycles.

Final Thoughts: Rethinking “Best Price” in the Turkish Cocoa Powder Market

In Türkiye’s competitive manufacturing landscape, the best price for cocoa powder is one that aligns with your factory’s long-term production goals—not the one that trims a few lira off a single order.

Reliable supply, technical consistency, and supplier partnership are what truly drive cost savings on the factory floor. Spanish-origin brands like Latamarko demonstrate how precision manufacturing leads to predictable performance, while experienced suppliers like MT Royal bridge the gap between affordability and reliability for industrial buyers.

latamarko alkalized cocoa powder lm60

cocoa powder for chocolate production-Best price

Food industry raw materials – list of products

Types of Gelatin from Turkish Manufacturer

Alkalized Cocoa Powder Bulk Supplier

Istanbul import export company

No comment